Requirements to Apply for the Student Loan

Answer:

Higher Education Students’ Financing Board (HESFB) is a body Corporate established by an Act of Parliament, No. 2 of 2014, to provide Loans and Scholarships to Ugandan Students who wish to pursue Higher Education in recognized Ugandan Higher Education Institutions, but are unable to support themselves financially. HESFB implements the Higher Education Students’ Financing Scheme which inclu es both the Students’ Loan Scheme and the

Students’ Scholarship Scheme.

Answer:

It is inten ed to address the following objectives: –

- To increase equitable access to Technical and Higher Education;

- To support highly qualified Ugandan students who may not afford Higher Education;

- To ensure regional balance in Higher Education services in Uganda;

- To support courses critical for national development.

- To ensure a sustainable revolving loans fund.

Answer:

Eligibility to the Student Loan Scheme considers;

- Be a Ugandan Citizen

- Be admitted to pursue an accredited undergraduate diploma or degree

programme in a listed Higher Education Institution, private chartered

university or public university in Uganda. Accreditation is by the National

Council for Higher Education (NCHE) - Have a financial need

- An applicant must be a joining in the first year or Continuing Student.

However, the Board currently funds final year students among the continuing

students. - The Board also takes into consideration regional balance, gender, social

economic needs and equity.

Answer:

Application is online through the HESFB Website; www.hesfb.go.ug. Applicants will be required to attach all the listed requirements.

Answer:

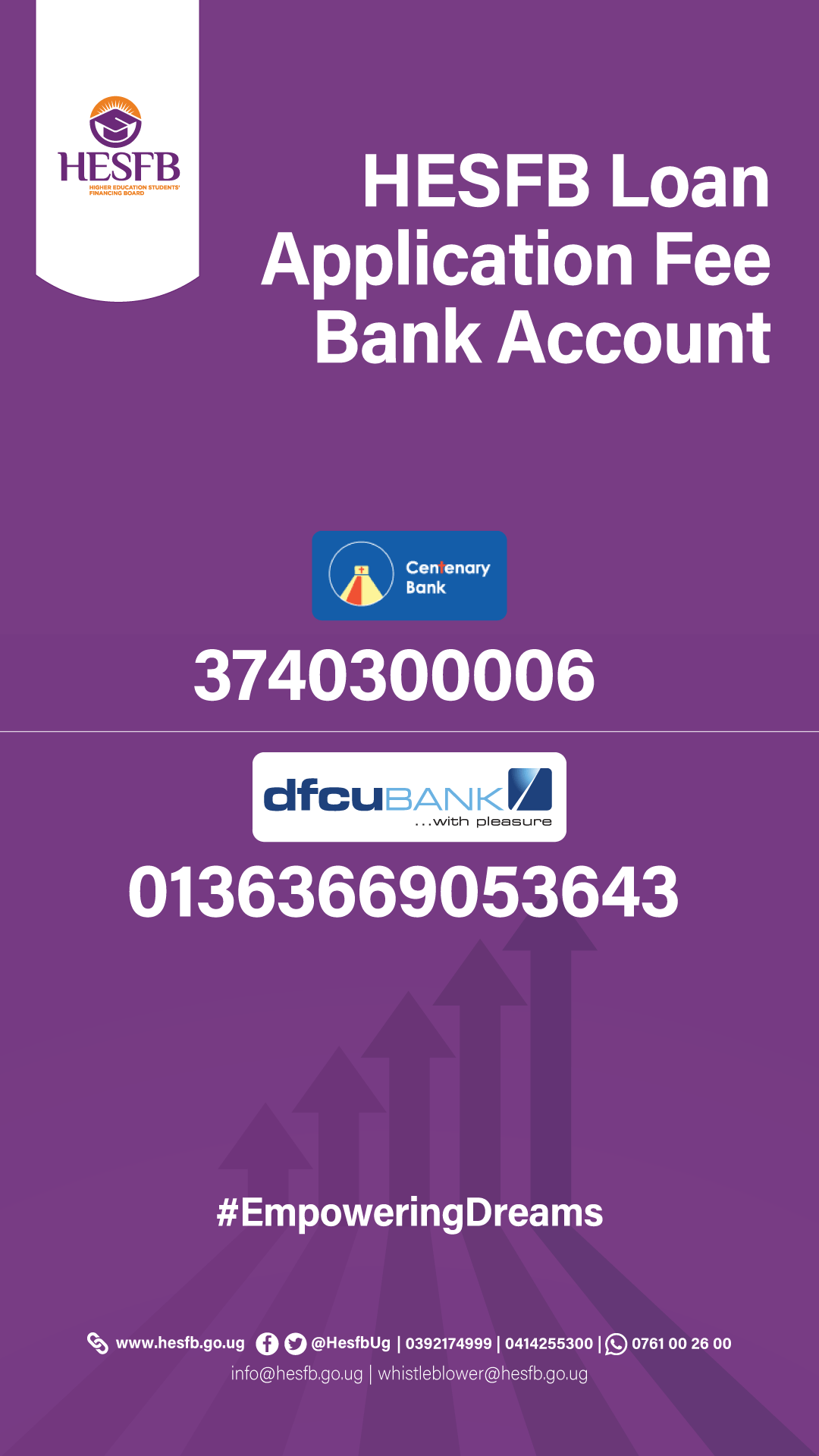

Application for a student loan will require one to upload the following;

- A copy of admission letter from any of the participating HEI

- A copy of the National ID

- Copies of academic certificates or result slips and transcripts

- A copy of a birth certificate

- A copy of the recent passport photo

- Proof of payment of the prescribed processing fees

- A copy of the Financial card (Not mandatory at the point of application)

- A sketch map of applicant’s current address/residence

- A sketch map of applicant’s home of origin (if different from current address)

- Fully filled loan application form submitted online.

Note: Applicants will receive a notification upon successfully submitting the

application details through email.

Answer:

The Student Loan Scheme is a cost sharing initiative. The Loan strictly covers the academic component, i.e., Tuition fees, Functional fees, Research fees, Aids and Appliances for Persons with Disabilities (PWDs). A student loan beneficiary is expected to cater for their welfare expenses (accommodation, feeding, medical care, scholastic materials) and any other expenses required by the student outside what HESFB finances.

Answer:

Currently the scheme supports students pursuing selected Undergraduate Diploma and Degree Programmes in Science, Technology, Engineering and Mathemetics (STEM). Persons with Disabilities (PWDs) are eligible to pursue either Sciences or Humanities programmes.

Answer:

This is possible. However, the student must seek approval from their institution and from the Board. These changes attract fees as stipulated in the tariff guide.

Answer:

The loan amount is remitted directly to the Higher Education Institution on a semester basis upon submission of a Subsequent Loan Application Form (SLAF), by the student. However, funds for aids and appliances applicable to PWDs may be deposited directly onto the Beneficiary’s account.

Answer:

A Student Loan Beneficiary can be disqualified on the following grounds;

- Discovery of document and information falsification

- Failure to progress academically

- Change of citizenship from being a Ugandan national

- Conviction of a crime

- Dismissal by the Higher Education Institution

Answer:

A Beneficiary will be required to request for funding only when they need i . A Student

can also exit the Scheme if they acquire an alternative source of funding.

Answer:

In this case, HESFB must be notified immediately on presentation of an authentic death certificate by the family of the Beneficiary or Loanee. The Board shall write off the outstanding loan amount against the Loan Protection Fund.

Answer:

Every Student contributes 1% of the annual gross loan amount as Loan Prote tion

Fee. This indemnifies the borrower against death and permanent incapacitation.

LOAN PROTECTION FUND BANK ACCOUNTS

Centenary Bank – 3100045970

DFCU Bank – 01363669053689

Answer:

Every student loan is repayable with a value retention fee. The value retention fee is determined by the Minister of Education and Sports in consultation with the Minister responsible for Finance upon recommendation by the Board. Currently the value retention rate is 7% per annum charged on reducing balance.

Answer:

The maximum repayment period is twice the study period in addition to the grace period of one year. There is also room to negotiate favorable repayment terms, including early repayments.

Answer:

Accordin to the HESF Act, the grace period is 12 cale er completing

the study programme for which the loan was awarded.

Answer:

Early Repayment comprises any amounts paid back to the Board during the period of study and before end of the Grace Period. Amounts paid within this period does not attract Loan Retent on

Fee/interest. This also facilitates a clean record with the Credit Reference Bureau.

Answer:

All Loan Beneficiaries are obliged to pay back all loan amounts advanced to them irrespective of failure to complete the course of study, except in the case of death or permanent incapacitation of the Beneficiary.